ADT - Cleansing the Sole

Market leader in Security, trading at ~5.5x EBITDA. Exiting the disaster solar foray and selling Commercial Security to reduce debt. Cleaner business with +ve EPS revisions and net debt sub 3x by y/e.

SUMMARY - ADT has been in a deep dark hole. They bought a solar installation business for $885m. It immediately started to print losses impacting the core security business which has continued to growth. This “diworsification” along with a heavy debt load caused a de-rating. There is light at the end of the tunnel. They have made the painful decision to close solar and have sold their commercial security business for 11x EBITDA. Net debt will be sub-3x and the core business is trading at ~5.5x EBITDA with positive earnings revisions.

ADT is the $6bn market leader in home security. They have ~30% market share which is close to 2x their nearest competitor. It is a fragmented market with thousands of smaller and regional players. The market is growing at 6-8%.

The business model is simple. They predominantly sell security systems to homeowners with a service component that drives monthly recurring revenue. 85% of their revenue is recurring driving predictable cash flows.

ADT’s has strong brand recognition which has been augmented by strategic partnerships with Google (2020) and State Farm. They both have equity stakes in ADT (6% @ $14 and 15% @$9 respectively).

State Farm is far larger than ADT (90m vs 6.5m). This lowers subscriber acquisitions costs (lower sales and marketing costs). ADT is partnering in 13 states (adding 4 more) which account for 40% of their policies currently. Customer satisfaction is 97%.

The Google partnership is more important given the strength of the NEST portfolio which is fully integrated into ADT’s product suite. Google attracts a better customer for ADT. Google products have a higher NPS, higher product satisfaction, more positive comments on functionality, dependability, even aesthetics. Google’s products drive higher attach rates vs white-label products. The proliferation of products (video doorbells, cameras, thermostats etc.) driven device penetration higher. 57% of customers now have 10+ devices in their home vs 23% before the partnership was signed. 4-year retention rates for customers with 10-plus devices is about 50% better than those with fewer than 10 devices.

The key metrics to watch are customer retention, ARPU, creation multiple (how long it takes you to breakeven).

Customer Retention - The average subscriber life is ~8 years and has been improving. I would argue that this will continue with higher rates meaning more homeowners are going to stay in situ rather than face refinancing at higher rates. The largest driver of churn is relocations. In addition, 4-year retention rates for customers with 10-plus devices is about 50% better than those with fewer than 10 devices.

ARPU - this has been going up due to increased devices per install.

Creation Multiple (how long it takes to breakeven) - this has been improving due to a higher ratio of ARPU/subscriber acquisition costs. The revenue payaback is now down to 2.1 years.

The stock has been poor due to “diworsification”.

ADT entered the solar install market (paying $885m) and it was an unmitgated disaster (they lost $117m of EBITDA on $330m of revenues). They have decided to exit residential solar (couldn’t give it away) which removes a -ve and simplifies the business model.

Capital allocation is now focused on delveraging. They sold their commercial business for $1.6bn (sold for 11.2x EBITDA vs trading at 5.5x) bringing net debt to EBITDA down from 3.9x to 3.2x yoy. All of the debt is now fixed at a weighted average rate of 4.5% and they have no sigificant debt maturities until 2022. The corporate debt was upgraded by both Moody’s and S&P.

The underlying business model (ex-Solar) has been good and they will bne sub-3x at year end allowing them to start buying back stock.

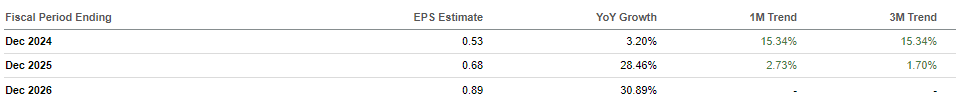

The stock is cheap trading at 12.6x non-GAAP FWD, 9.75x GAAP FWD. The worst of the -ve EPS revisions appear to be behind us and even have started to trend higher.