In March 2020, S&P Global published analysis of stock buybacks. They concluded that over the long run, the stocks with the highest buyback ratio in the trailing 12-month period provided superior returns at lower risk. In the 20 years to 2019, the S&P buyback index had outperformed in 16 out of 20 years.

Buybacks are now considered a core tool of capital allocation. For fast growing industries, it is used to offset dilution from share based compensation. For mature industries with limited options for reinvestment, buybacks are used to drive earnings growth. This latter group is often called THE CANNIBALS. Mohnish Pabrai found that this group of stocks generated an impressive 15.5% annualised return for the 1992-2016 period, compared to 9.2% for the S&P 500.

The most cited example in modern times is Autozone, a company that operates in the mature auto parts industry. A combination of LSD comp, MSD store growth, an expanding OM, a focus on cash conversion and a very aggressive buyback led (share count down by 9% CAGR) to significant stock apprciation. AutoZone’s share price has grown by almost 94x from 1999 to March 2024.

Buybacks are a relatively recent phenomena. For me, the orginal share cannibal was TELEDYNE TDY 0.00%↑ led by founder Henry Singleton. William Thorndike’s Outsider Book highlights Singleton’s capital allocation skills and his ability to pivot between M&A and buybacks.

USE YOUR EXPENSIVE CURRENCY FOR M&A - Between 1965 and 1970, he acquired 130 companies using Teledyne stock (purchase multiple ~10x vs TDY stock trading 40—70x).

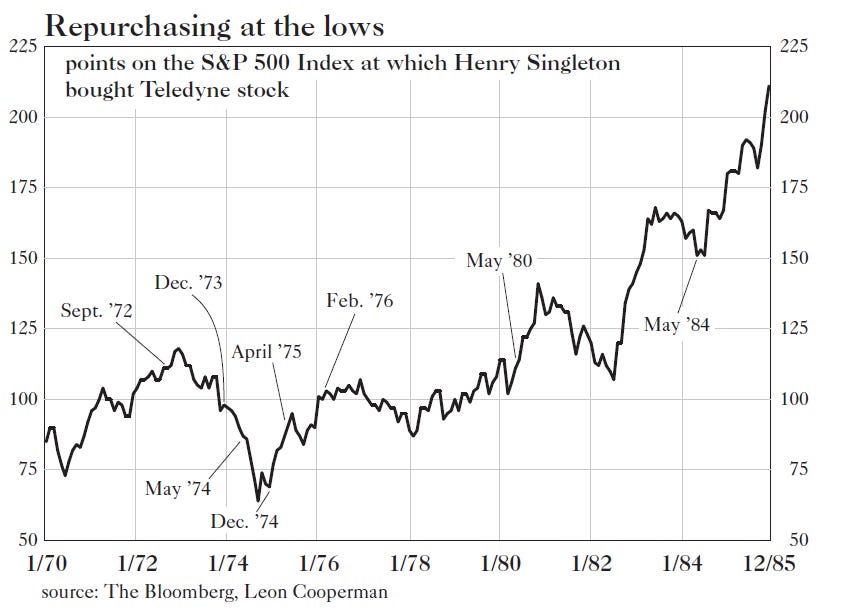

BUYBACK YOUR CHEAP STOCK - After the stock price fell ($65 in ‘65 to <$8 in 1970s bear market), he pivoted to cannibal mode. Between 1972 and 1984, TDY had bought back >90% of their outstanding shares through 9 tenders. The first tender was in 1972 when the stock was ~$20. By Sept 1984, the stock had hit $302.

If you had invested a dollar with Singleton in 1963, by 1990, when he retired as chairman in the teeth of a severe bear market, it would have been worth $180. To learn more about Singleton this is an excellent source.

Teledyne ($TDY) still lives on today (market cap ~$20bn). Teledyne is a supplier of enabling technologies to sense, transmit and analyse inforamtiona for a diverse group of end markets include A&D, factory automation, medical imaging, machine vision, environmental monitoring etc. Many of the traits that Singleton focused on are still applied at Teledyne today:

Decentralised operations with focus on cost control - “It’s something we do day in and day out regardless of what the maroeconomics are. We control everything. We control expenses in travel, we eliminate square footage in our manufacturing facilities, everything we do we’re vigilant.” Robert Mehrabian, TDY CEO/Chairman

This has driven a steady improvement in EBITDA margins

Niche products with dominant market shares - they call it rational oligopolies

This supports a high and increasing GM

Mission Critical Products/Hard to Replicate- TDY’s products operate in tough environments where product quality/reputation are more important than price. Where there is a very high cost of failure and few/no readily available substitutes.

Track record of disciplined M&A - since 2001, they have made 70 acquisitions w $11.9bn spent. The largest was in 2021 when they acquired FLIR Systems for $8bn (40% of TDY’s mkt cap, 17x EBITDA, leverage rose to 3.5x).

TDY target a margin increase of 50bps per annum and a cash return of 10% over three years.

The FLIR acquisition met their syngery targets 6 months before the orignal expected date by reducing depend on 3rd party consultants and lobbyists.

Conservative Guidance

They have missed only 4qtrs in 25 years

Strong Culture

Management are paid on LT outperformance of the Russell 2000

Why now?

Weaker $ a tailwind - 50% of TDY’s sales come from international markets

Balance Sheet Delevered - net debt to EBITDA has fallen to 1.7x (without aquisitions should be 1.3x by y/e) and that allowed them to restart the buyback in April ($1.25bn authorisation) and look at M&A (have capacty for $1.5bn to $2bn deal). Their target range is 1.5x-2.5x. Currently paying 2.35% on debt.

LT Tailwinds - from reshoring, automation (air quality monitoring, industrial automation), and rising defense spending

Supply Chain Issues behind them - in 1Q23 they bought $10m from electrronic suppliers brokers vs $2m in 1Q24

Latest Results Strong

Record Backlog - orders have exceeded sales for three consecutive quarters and now stands at 1.07x

All-time record free cash flow - they generated $576m in FCF in the first 2 quarters vs a FY target of >$900m

Integration of FLIR nearing completion - this was TDY’s largest M&A deal. The deal closed in May 2021 and by 2Q22 they announced margins that were 1%age point below consensus driven primarily by supply chain challenges in digital imaging. The integration is nearing completion allowing them

Attractive Valuation - the acquisition of FLIR and the impact from supply chain/inflation has de-rated the stock to an attractive ~6% FCF yield, 21X fwd P/E (27X 5-year average)